2500+

Successful Projects

Table of Contents

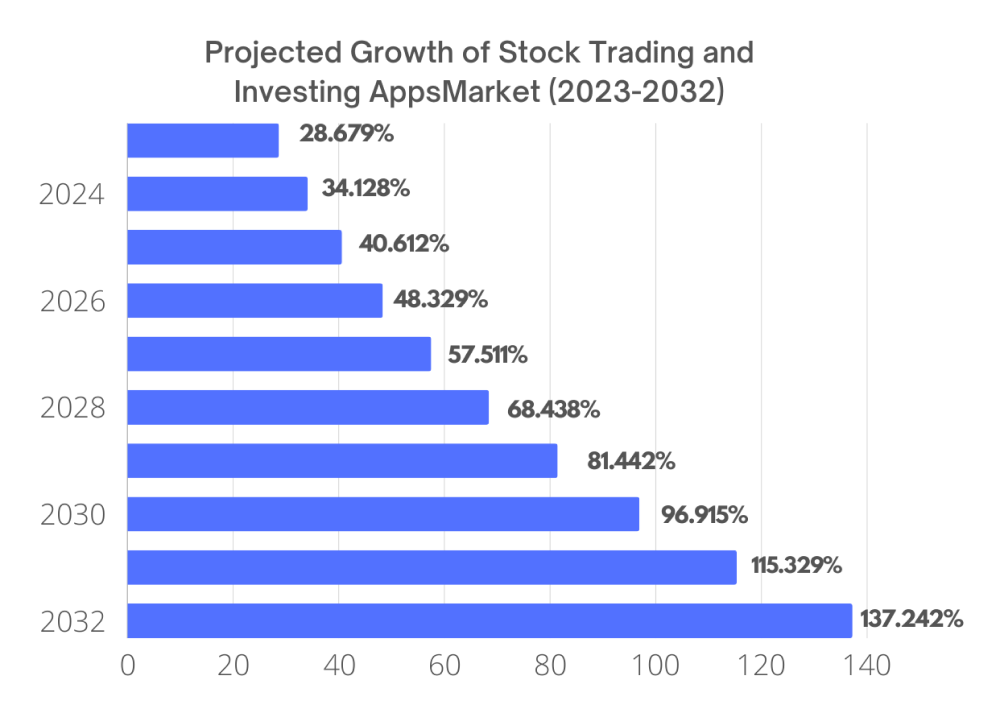

The market for stock trading and investing apps was estimated to be worth USD 24.1 billion in 2022, and between 2023 and 2032, it is projected to grow at a compound annual growth rate (CAGR) of more than 19% (gminsights). Access to up-to-date market information, news, and financial analysis instruments is a crucial driver of market expansion.

To make wise judgments in the fast-paced world of finance today, traders and investors need access to real-time information. Apps that provide customers with extensive analytical capabilities and real-time data enable them to remain ahead of the competition.

Trends in stock trading and investing applications allow you to spot possibilities and efficiently manage risks. This feature increases these programs' overall attractiveness and user base by drawing in experienced traders and inexperienced investors.

Stock trading and investing applications market report attributes

Report Attribute | Details |

Base year | 2022 |

Stick Trading and investing applications market size in 2022: | USD 24.2 Billion |

Forecast period | 2023 to 2032 |

Forecast period 2022 to 2032 CAGR | 19% |

2032 Value Projection | USD 126 Billion |

Historical Data for | 2018 to 2022 |

The market for investing and stock trading apps is expanding as a result of the ongoing development of technology. These programs provide users with advanced capabilities for trading, portfolio management, and risk assessment by using cutting-edge technologies like blockchain, artificial intelligence, machine learning, and data analytics. Trade management is becoming more lucrative, accessible, and efficient because of the application of features like automatic portfolio rebalancing, predictive analytics, and algorithmic trading made possible by technological advancements.

Security is one of the industry's most significant obstacles when investing and stock trading apps are used. Financial markets may be disrupted, and cyberattacks, data breaches, and hacking efforts may compromise customer data. Sophisticated cybersecurity techniques are necessary to reduce these dangers. Security may be improved by putting multi-factor authentication, sophisticated encryption techniques, frequent security audits, and real-time activity monitoring for unusual activity into place. A more secure trade environment may also be achieved by providing cybersecurity training and educating users about safe online activities. Collaborating with cybersecurity professionals and keeping up with new threats is essential to protect financial systems and user data.

Market Trends for Stock Trading and Investing Applications

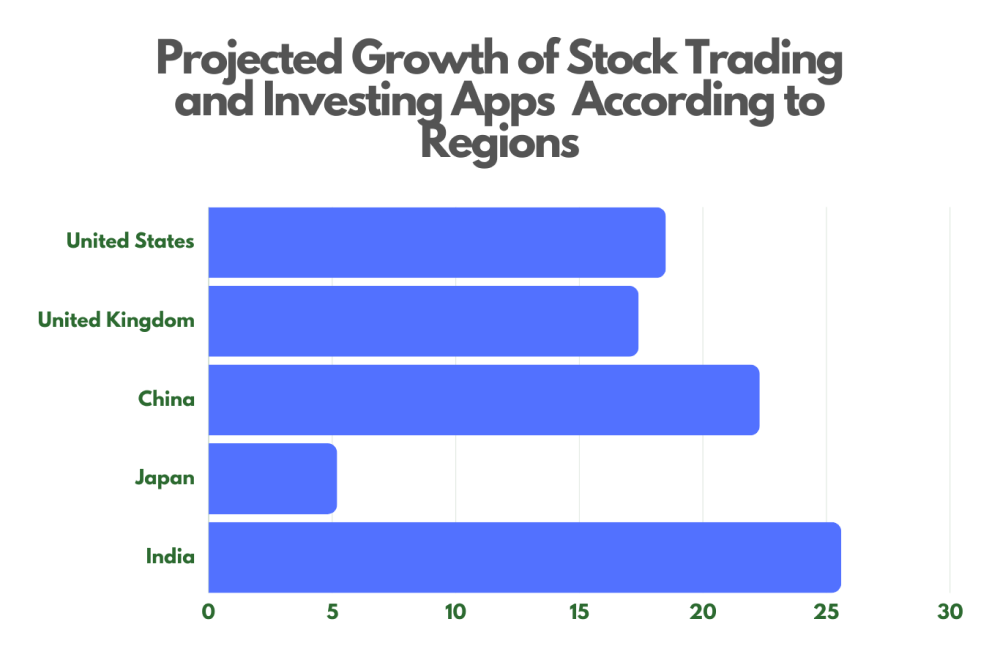

Robo-advisors are becoming more and more popular because of their capacity to manage portfolios according to customer preferences and risk tolerance, and to provide individualized investing advice. These online platforms are changing how people approach investing by providing practical and affordable options. For example, the London-based neobank Revolut streamlined user investment portfolio management in June 2023 by adding a robo-advisor to its super app in the United States. therefore, not only united states the consumption of stock trading and investing applications has increased in particular regions like china, UK, Japan, and India (futuremarketinsights). The investment management industry is changing thanks to robo-advisors, algorithm-driven platforms that provide automated, economical, and individualized financial advice.

By incorporating social components into the financial realm, social trading platforms allow users to mimic and follow the trading tactics of seasoned investors. This tendency encourages merchants to share expertise and to feel a feeling of community. The achievements and insights of others may be helpful to investors, democratizing access to the financial markets and perhaps enhancing trading results overall. It is a dynamic change in the financial sector that may benefit professionals and beginners alike by offering a transparent and cooperative approach to investment.

The financial industry is enormous and scary, particularly to newcomers. Fortunately, many trading and investing applications are available to make your trip easier. But it might be not easy to choose the best solution when so many are available. This article examines many app categories to assist you in selecting the best option for your financial objectives from finance app development guide.

These automated investing platforms provide financial planning services based on algorithms. These applications provide users with tailored investing advice according to their financial objectives, risk tolerance, and preferences. The benefits of robo-advisors include their low costs, simplicity of use, and accessibility to even beginner investors.

With stock trading applications, investors may trade stocks, options, exchange-traded funds (ETFs), and other assets from their smartphones. These systems enable users to efficiently monitor and manage their assets by offering real-time market data, news updates, technical analysis tools, and customizable dashboards.

These applications allow users to exchange virtual currencies like Ethereum, Bitcoin, and other cryptocurrencies. They include features such as access to a range of digital assets, safe transactions, and real-time price monitoring. Investors interested in the volatile and often changing cryptocurrency industry may use cryptocurrency applications.

Designed with simplicity in mind, lite investment applications cater to consumers who may not possess extensive trading experience. To draw in new users, these applications provide commission-free trading, robo-advisors for automatic financial advice, configurable dashboards and instructional material, push alerts for market updates, and easy-to-use user interfaces.

Apps for Value-Based Funds concentrate on reputable businesses that provide dividend payments and are seen as less hazardous than high-growth equities. Using these applications, investors search for stocks selling below their value and study a company's financial fundamentals to make well-informed investing selections.

Investment applications that focus on socially and ecologically conscious investing are known as ESG (Environment, Social, and Governance) apps. These applications allow users to invest in businesses that address issues such as inequality, sickness, and climate change. Financial rewards are aligned with social and environmental impact via ESG investing applications.

The significance of the stock, cryptocurrency, and bullion markets vary significantly in the financial sector.

To compare in tabular form the distinctions between bullion, cryptocurrencies, and the stock market:

Aspect | Stock Market | Cryptocurrencies | Bullion |

Nature of Investment | Shares of publicly traded companies | Digital assets decentralized from banks | Physical precious metals like gold |

Volatility | Prices influenced by company performance | Highly volatile, influenced by demand | Relatively stable, less volatile |

Liquidity | Shares are highly liquid | Liquidity varies, influenced by demand | Liquidity can be a concern for physical |

Inflation Hedge | Effective hedge against inflation | Seen as a hedge, but more speculative | Historically a strong hedge against |

Diversification | Provides diversification benefits | Offers diversification but volatile | Diversifies portfolio, not correlated |

Market Influence | Influenced by company performance | Influenced by market sentiment | Affected by economic factors and demand |

Apps | Robin hood, Acrons | WazirX, eToro |

There are few applications that provide trouble-free stock market education to consumers.

Investigate the world of the "best stock market app" and arm yourself with information to help you make wiser financial choices.

You have to allow users to invest, right? The easiest thing to accomplish is enabling the biometric identification features that your target smartphone supports –Face ID, Touch ID, or their equivalents on Android phones –for improved security and user data protection. You also need to implement two-factor authentication (using a phone number, email address, or auth app).

However, you also want to collect some user's information so that you can build their profile on the back end. That may assist you in coming up with the best strategies to get them to spend more, more often, etc. Analyzing their social media profiles and enabling them to check in with Facebook or other accounts is one way to do this.

Integrating users' bank accounts is an essential step in an investing app's onboarding process. One way to do so is by integrating with the Plaid API, which is already a virtual method of securely combining bank accounts with financial applications. We would further argue that without Plaid or direct bank interfaces, it is impossible to create an investing platform that accepts fiat currency.

We can always sweep up all the supporting information that isn't constantly in the spotlight in the user profile:

A dashboard or home screen of some kind is necessary so that users can see how much money they have invested and whether or not their investments are increasing.

That's also where we can show them the stocks and other assets they hold, together with their purchasing power—an account with money set aside to buy equities.

The main feature of any investing application is the ease of buying or selling stocks or other financial assets. Consumers anticipate seeing a line or candlestick chart, corporate information, and other pertinent details for a particular stock. For instance, in Robinhood, they demonstrate:

Additional equities that investors often purchase

Additionally, users may wish to establish a stop-loss price there to sell stocks when they hit a specific price automatically.

Many investing programs generate revenue by charging fees for trading transactions executed on the back end. Still, this is not required. You may also investigate other forms of monetization, such as receiving payment from partners who act as market makers.

Users consume market news relevant to their stock selections in the newsfeed. To further transform our trading app into a social investing experience, we may include a social feed that features other users' comments, investment portfolios, and other information. That's how to design a trading platform that attracts new users the most.

Users need a stock and option search tool that is both powerful and user-friendly. A good search function would allow the user to search for stocks by the firm's name rather than just the symbol, such as Apple for AAPL.

When developing a stock market application, analytics, and stock categorization according to trends, stability, etc., are important aspects to consider. A stock is simple to add to favorites and evaluate later.

Push alerts in trading applications often involve monitoring stock prices or signaling the completion of a buy or sell transaction.

There are many exciting opportunities when creating an app for trading or investing, but it's essential to understand the intricate world of financial rules. Below is a summary of the main points that developers should think about:

Securities and Exchange Commission (SEC): Depending on its functionality (e.g., managing investment accounts and providing securities), you may need to register your app with the SEC as a broker-dealer, Investment Advisor, or Transfer Agent.

Financial Industry Regulatory Authority (FINRA): You may need to be a member of FINRA if your app allows you to trade securities. This means abiding by their policies about reporting, fair practices, and client protection.

State-Level Licensing: Many states have laws governing broker-dealers and investment advisers. You must find out about and abide by any state licensing requirements.

Know Your Customer (KYC): You will probably need to implement KYC protocols to confirm user identities and determine whether they are financially qualified for suggested investments. This lessens the chance of money laundering and fraud.

Anti-Money Laundering (AML): Complying with AML requires keeping an eye on transactions for any unusual behavior and notifying the authorities of any possible infractions.

Laws Governing Data Protection: The Gramm-Leach-Bliley Act (GLBA) and several state laws govern financial institutions' data security and privacy. You'll need strong security measures, such as access limits and encryption, to secure user data.

General Data Protection Regulation (GDPR): The GDPR regulates data collecting, storage, and user rights. You must follow this regulation if your app is used in the EU.

Anti-fraud provisions: Claims on investment performance in marketing materials must be truthful and accurate and not misleading or deceptive. Respect the rules on advertising established by FINRA and the SEC.

Risk Disclosures: Before making any purchases, users must be given a clear and explicit explanation of the risks involved with the assets being provided.

Updates on Regulations: Rules governing finance are subject to modification. Keep abreast of regulatory developments and modify your app as necessary.

Frequent Audits: Depending on your registration and license, your app may be subject to audits to verify compliance with legislation.

Cybersecurity: Apps related to finance are often the subject of hacks. Establish robust security protocols and a strategy for handling incidents.

Accessibility: Make sure your application complies with laws such as the Americans with Impairments Act (ADA) and is usable by people with impairments.

A well-designed platform guarantees ease of use and transparency throughout the trading procedure. The platform's functionality allows new investors to quickly get acquainted with it and complete transactions without needless difficulty. UX designers put a lot of effort into creating user-friendly navigation, accessible language, and symbols so that even those without previous financial expertise can grasp the trading process.

Furthermore, UX design is concerned with crafting unique experiences for every user. This makes it simple for investors to personalize the interface to suit their requirements and tastes and to see pertinent information, statistics, and alerts to remain updated on market movements.

Thanks to user-friendly and appealing interfaces, trading stocks and cryptocurrencies has become less scary and more entertaining. Gamification components are another tool that UX designers use to inspire investors to reach their objectives and advance their financial literacy.

Finally, there is little doubt that the creation of mobile applications and responsive websites has dramatically increased the accessibility of stock trading. The market is now more flexible and open since investors may trade whenever it's convenient for them on their cellphones and tablets.

The following are some user experience design guidelines for trading and investing applications based on the sources given:

Create easy-to-use and intuitive applications so that users can finish activities without being distracted by extraneous information. The app's functionality should be easy for users to grasp and implement in various situations.

Add gamification components to your website to boost user engagement and motivate desired behaviors. But it's essential to find a balance and refrain from overdoing the gamification, particularly in financial applications where gravity is paramount.

Functional animations can improve user interface design, lead users through the application, lessen cognitive strain, and prevent users from missing significant changes. Subtle functional animations that complement the app's functionality are ideal.

Take advantage of micro-interactions to make people happy, provide a lively environment, and give them feedback on their work. These little details make a big difference in the user experience overall and set an exceptional design apart from an average one.

Use graphs and charts to present data in an understandable and visually attractive way. Data visualization helps consumers make financially informed choices by simplifying complicated information into easily understood insights.

Make sure everyone, including people with special needs or impairments use the software. Adopt accessibility guidelines such as the Web Content Accessibility Guidelines (WCAG) to provide every user equal chances and increase the app's visibility to a wide range of users.

Using these UX design principles in investment and trading applications may improve usability, engagement, and overall user happiness, eventually resulting in a good and productive user experience.

We are nearing completion on creating an application for investing and wealth management for a well-known company that will soon democratize retail investment for a sizable market. The app incorporates a well-balanced mix of the features we discussed in this blog and some of the client's know-how, which we put together into a strong tech and UX/UI framework. However, the project is under NDA as the team puts the final touches on it, so I can't reveal any details now.