2500+

Successful Projects

In major cities around the world, booking a cab is just a tap away. Whether it's about booking Lyft in Los Angeles, Bolt in the UK, Ola in India, or Grab in Singapore, the taxi-hailing apps have entirely transformed traditional transportation. Today, there are tons of ridesharing apps, but none of them have beaten the popularity of the original transport disruptor, Uber.

Uber, being the largest ride-hailing service in the world, operates in 65 countries and over 700 cities. At the same time, the company witnessed a 17% increase in its revenue in 2023, with it reaching a whopping $27 billion. Despite this popularity and widespread adoption, there has been a constant uptrend of users searching for ‘Uber Alternatives.’

Table of Contents

As different taxi apps around the world are making efforts for affordable urban mobility, it's hard to think of a company that has a more global impact than Uber. However, the past and the recent scandals of Uber, whether it was the Super Bowl, harsh driving, or women feeling unsafe, have put the company under the user’s radar.

So, if you’re also the one searching for Uber alternatives, this article is a must read for you. Whether you reside in the US, the UK, India, or any other part of the world, we will find the best local alternatives to Uber in your region that offer a much more affordable and safe ride experience. So, let’s get started!

The ride-hailing and taxi industry is experiencing a significant surge in demand, primarily driven by consumers' efforts to avoid the high costs associated with owning a private car. This trend is particularly evident in the increasing popularity of ride-hailing services, which offer a convenient payment system, transparent pricing, the ability to identify drivers through the app, and door-to-door service.

The global ride-hailing and taxi market was valued at USD 13.10 billion in 2022 and is projected to grow from USD 13.98 billion in 2023 to USD 23.48 billion by 2031, at a CAGR of 6.7% during the forecast period (2024-2031).

The rise in urban population due to migration for employment purposes has led to increased traffic congestion and a lack of parking space, further encouraging the shift towards ride-hailing and taxis as preferred modes of transportation. However, the growth of this industry is constrained by environmental concerns and complex regulations worldwide.

If you’re done with Uber or its drivers keep canceling your trips (which is a common problem with this app), it's high time to switch to other apps. But the problem is that there are only a few ride-hailing apps that offer global services like Uber. But you don’t have to worry in that case, too, as we have curated a lits of top Uber alternatives in different countries, alongside their average fare and active users. So, let’s start with the US.

The US ride-hailing market is dominated by Uber, but there's a growing number of competitors offering various options. While convenient and popular, ride-hailing services can vary in pricing and availability depending on your location.

Here's a table showcasing some popular Uber alternatives in the US:

Company | Active Users (Millions) | Average Fare (USD per mile) |

Lyft | 40+ | $1.25 - $2.00 |

Via | 10+ | Varies (often cheaper than Uber/Lyft) |

TaxiHail | 5+ | Metered fares (often higher than ridesharing) |

Gett | 5+ | Varies by city |

Flywheel | 3+ | Varies by city & car type (often luxury vehicles) |

Juno (arriva) | 2+ | $1.00 - $1.75 |

BzzRide | 1+ | Varies by city |

Curb | 1+ | Varies by city (often taxis & ridesharing) |

HopSkipDrive | 1+ | Varies by city |

Roundel | 1+ | $1.50 - $2.50 |

The UK ride-hailing market is thriving, projected to reach over $11 billion by 2024. While Uber remains the dominant player, a vibrant app landscape offers competition and varied choices that are included in the below table.

Here's a table showcasing some top Uber alternatives in UK:

Company | Active Users (Estimated, Millions) | Average Fare (USD) |

Bolt | 12 | $7-$10 |

Free Now | 8 | $8-$12 |

Kapten | 5 | $9-$13 |

ViaVan | N/A | $5-$8 (shared rides) |

Gett | 4 | $10-$15 |

Addison Lee | N/A | $12-$18 |

Kwik Ride | 3 | $6-$9 |

Bluecar | 2 | $8-$11 (electric vehicles) |

Saucel | N/A | $15-$20 (luxury cars) |

Hailo | 2 | $7-$11 |

The taxi app market in India is flourishing, driven by factors like increasing smartphone penetration, a growing young population, and a rising demand for convenient transportation.

The market is expected to reach over 150 million users by 2028, with a projected revenue of over $7 billion. However, the average user penetration remains relatively low, indicating significant room for further growth.

Here's a table outlining some of the top local Uber alternatives in India:

Company | Active Users (Million) | Average Fare (USD) |

Ola Cabs | 100+ | 3-5 |

Meru Cabs | 20+ | 4-6 |

Mega Cabs | 15+ | 3-4 |

TaxiForSure (acquired by Ola) | - | - |

Savaari Car Rentals | 10+ | 5-7 |

Uber India | 15+ | 4-6 |

Jugnoo | 5+ | 2-3 |

BluSmart (electric cabs) | 3+ | 4-5 |

Cab-E | 5+ | 1-2 |

Quality Cab | 2+ | 3-4 |

The Australian taxi app and cab services market is experiencing a period of transition. While the overall market size is expected to grow in the coming years, traditional taxis face stiff competition from ride-sharing apps like Uber.

Here are the top local Uber alternatives in Australia

Company | Active Users (Millions) | Average Fare |

Ola | 2.5 | $35 |

Didi Chuxing | 1.8 | $32 |

Shebah | 1.2 | $40 (focuses on premium rides) |

The Canadian taxi app and cab services market is undergoing a transformation. While traditional taxis still exist, ride-hailing apps like Uber have gained significant popularity, offering convenience and competition. This has led to a decline in traditional taxi revenue and a wider variety of choices for consumers.

Here's a table summarizing some popular Uber alternatives in Canada:

Company | Active Users (Estimated) | Average Fare (CAD) |

Lyft | Over 1 million | $25-35 |

Poparide (Carpooling) | Over 500,000 | $10-20 (depending on distance) |

Moov | Over 200,000 | $20-30 |

HalloTaxi | Over 100,000 | $25-40 |

JUMP (Owned by Uber) | Data Not Available | Similar to UberX |

Rakuten Taxi | Over 50,000 | $20-35 |

The UAE taxi-hailing and cab services market is a thriving sector driven by a tech-savvy population, a focus on tourism, and a large expatriate community. The country’s ride-hailing segment is expected to reach $199 million in revenue by 2024, with a projected annual growth rate of over 5%.

Here's a table summarizing the top local Uber alternatives in the UAE:

Company | Active Users | Average Fare (USD) |

Careem | Over 10 Million | $5 - $12 |

Swvl | Over 1 Million | $3 - $8 |

Dubai Taxi (Hala) | N/A (Extensive Fleet) | Metered Fares |

Yahala | N/A (Limited Data) | Metered Fares |

Cars Taxi | N/A (Limited Data) | Metered Fares |

RTA Dubai (Sh RTA) | N/A (Extensive Fleet) | Metered Fares |

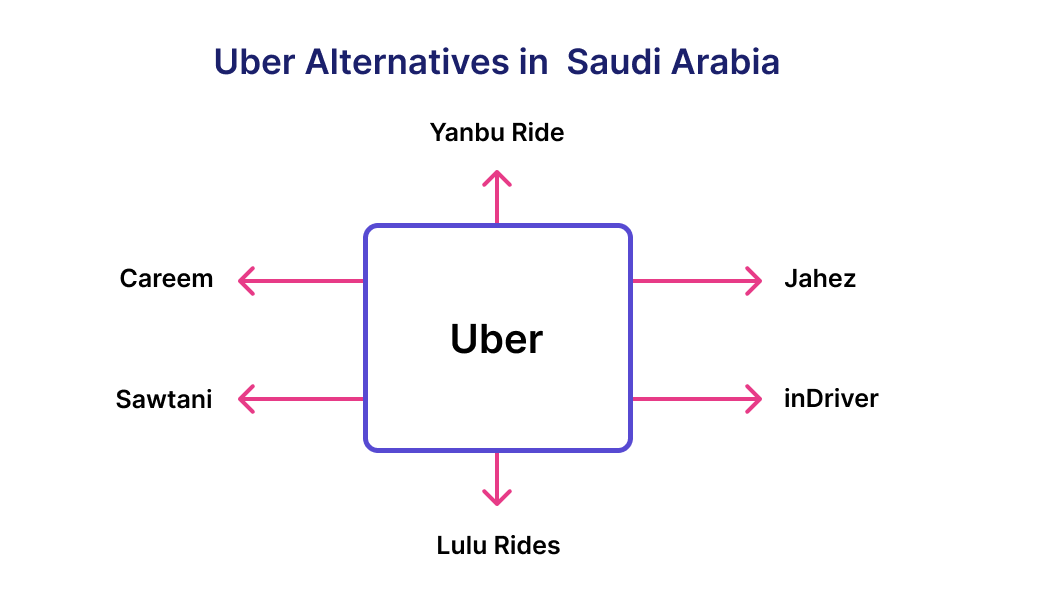

The region’s focus on digitalization is fueling the growth of ride-hailing apps, offering convenient and tech-driven alternatives to traditional taxis. The market is expected to reach $1.09 billion in 2024 but with a slight decline projected by 2028.

Here's a table summarizing the top local Uber alternatives in Saudi Arabia:

Company | Active Users (Millions) | Average Fare (USD) |

Careem (acquired by Uber in 2019) | 35+ [pre-acquisition data] | Varies by service (e.g., economy, luxury) |

Sawtani | 10+ | Competitive (often lower than Uber) |

Jahez | 5+ | Varies by service and distance |

inDriver | Data not publicly available | Negotiated fares between rider and driver |

Yanbu Ride | Data not publicly available | Focuses on specific cities, potentially competitive fares |

Lulu Rides | Data not publicly available | Varies by service |

Argentina's taxi and ride-hailing market is a dynamic scene offering a variety of options for both residents and visitors. It's seen significant growth driven by:

The availability of all major players caters to diverse needs with options ranging from budget-friendly to premium eco-conscious services.

Here's a table summarizing the top local Uber alternatives in the UAE:

Service Name | Active Users (Millions) | Average Fare (USD) |

BA Taxi | 2 | $10-$15 |

Taxi Premium | 1.5 | $12-$18 |

Cabify | 1 | $15-$20 |

Beat (acquired by Didi) | 3 | $8-$12 |

InDriver | 2.5 | $7-$20 |

SoyRemis | 1.8 | $9-$14 |

In Brazil, ride-hailing apps like Uber and 99 (acquired by Didi Chuxing) hold the majority of the market share, estimated at around 90% of active users combined. The government-backed taxi apps like Rio's "Taxi.Rio" are gaining traction, offering competitive pricing and convenience, leading some users to switch back to taxis.

Here are the top local Uber alternatives in Brazil:

Company | Active Users (Estimated) | Average Fare (USD) |

99 | Over 14 million | $5-8 |

Taxi.Rio (Government-backed) | Growing user base (Data not publicly available) | Varies depending on distance, potentially competitive with ride-hailing apps |

Localiza Me | Millions (Data not publicly available) | $6-10 |

InDriver | Gaining popularity (Data not publicly available) | Negotiable fares |

Cabify (Recently acquired by Maxi Mobility) | Millions (Data not publicly available) | $7-12 |

iTáxi | Millions (Data not publicly available) | $6-9 |

Egypt's taxi-hailing scene is a dynamic mix of global giants and innovative local players. While Uber remains a major player, several homegrown apps offer competitive fares and features.

Here's a table outlining some top Uber alternatives in Egypt:

Company | Active Users | Average Fare (USD) |

inDriver | Over 1 Million | Negotiable (often lower than Uber) |

Careem (acquired by Uber in 2020) | Millions (figures not publicly available) | Competitive with Uber |

Didi | Growing user base | Competitive with Uber |

EasyTaxi | Well-established presence | Varies depending on distance and car type |

Mwasalat Misr | N/A | Competitive fares |

Swvl | N/A | Affordable fares |

The French taxi market is well-established but is facing competition from ride-hailing apps. Regulations have limited the growth of global giants like Uber, allowing local players to thrive. Here's a table summarizing the top Uber alternatives in France:

Company | Active Users | Average Fare (USD) |

Kapten | 3 Million | $15-20 |

BlaBlaCar Daily | 2 Million | $8-12 (Carpooling) |

LeCab | 1.5 Million | $18-25 |

Marcel | 1 Million | $12-18 |

SnapCar | 700,000 | $10-15 |

AlloTaxi | N/A | Metered fare (similar to traditional taxis) |

Germany's taxi-hailing industry is a mix of traditional taxis and ride-hailing apps. While Uber faces regulatory hurdles, several local players offer strong competition. These apps prioritize features like real-time tracking, in-app payments, and a focus on certified drivers for a safe and reliable experience.

Here's a table summarizing the top local Uber alternatives in Germany:

App Name | Active Users | Average Fare (USD) |

FreeNow (formerly mytaxi) | Over 1 million | $10-15 |

Bolt | Over 500,000 | $8-12 |

Taxi.eu | Over 1 million (Europe-wide) | Varies by city (typically $12-18) |

BlaBlaCar (Carpooling) | Over 10 million (Europe-wide) | Varies by trip length (often cheaper than taxis) |

CleverShuttle (Ride-sharing) | Over 300,000 | Varies by distance (generally budget-friendly) |

Fahrgemeinschaft (Carpooling) | N/A | Varies by trip, typically negotiated beforehand |

Italy offers a mix of traditional taxis and modern ride-hailing apps. Taxis are regulated and metered, while app-based services provide convenience and sometimes lower fares.

Here's a table summarizing the top local Italy Uber alternatives:

Company | Active Users | Average Fare (USD) |

FreeNow (formerly MyTaxi) | 15 million+ (Europe) | $15-25 |

ItTaxi | 1 million+ | $10-20 |

appTaxi | Not available | $12-22 |

Uber (Limited availability) | Not available | $18-28 (Similar to taxis) |

Hailan | Not available | $8-15 |

TaxiClick | Not available | $12-20 |

Japan's taxi-hailing industry is a unique blend of tradition and innovation. Taxis are plentiful and efficient in major cities, but hailing apps offer additional convenience, especially at night or in the suburbs. Here's a table summarizing the top local Uber alternatives in Japan:

Company | Active Users | Average Fare (USD) |

Go Taxi | 10 Million+ | $15-20 |

S. Ride | 5 Million+ | $20-25 (Business-oriented) |

Dia | 3 Million+ | $12-18 |

MOV Mobility | 2 Million+ | $10-15 |

DeNa Call Taxi | 1 Million+ | $18-22 |

Nihon Kotsu Taxi | N/A (Taxi Company App) | Varies by distance (similar to regular taxis) |

Mexico's online cab services market is a competitive scene with both global giants and local players vying for users. Uber remains a major force but faces strong competition from Didi, a Chinese ride-hailing giant. Here’s a list of top local Uber alternatives in Mexico:

App Name | Active Users (Millions) | Average Fare (USD) |

Didi | 15 | $4-$7 |

Cabify | 5 | $5-$8 |

Beat (now owned by FREE NOW) | 3 | $3-$6 |

SinDelantal (offers ride-hailing) | 2 | $4-$6 |

Easy Taxi | 1 | $3-$5 |

Yaxi | 1 | $2-$5 |

New Zealand's online cab services market is dominated by ride-hailing apps, offering a convenient and cost-effective alternative to traditional taxis. The market is expected to grow steadily, with Uber being the leading player. Here's a table summarizing the top local Uber alternatives:

Company | Active Users | Average Fare (USD) |

Ola | 300,000+ | Varies (budget-friendly to luxury options) |

YourDrive | No data available | Competitive |

iHail | No data available | Competitive |

Green Cabs | No data available | Eco-friendly focus, potentially higher fares |

South Africa's online cab services market is thriving, driven by growing smartphone penetration and a demand for convenient transportation. While traditional metered taxis exist, app-based ride-hailing services are experiencing significant growth. Here's a table summarizing the top local Uber alternatives in South Africa:

Company | Active Users | Average Fare (USD) |

Bolt | 5 Million+ | $3-5 |

inDriver | 2 Million+ | Negotiable (often lower than Uber) |

Lyft | 1 Million+ | $4-6 |

SafeBoda | 500,000+ | $2-4 |

Yookoo Ride | 300,000+ | $3-5 |

Shuma Passenger | 200,000+ | Varies (budget-friendly options) |

The ride-hailing app market in Spain is thriving, with several local players competing alongside Uber. These services provide convenient and often more affordable alternatives to traditional taxis. Here's a table listing the top 6 local Uber alternatives in Spain:

Company | Active Users (Millions) | Average Fare (USD) |

Cabify | 3 | $10 |

FreeNow | 2.5 | $9 |

Bolt | 1.8 | $7.5 |

Artaxi | 1.2 | $8 |

Yandex Taxi | 0.8 | $9.5 |

Amovens | 0.5 | $6.5 |

Turkey's ride-hailing market is booming, fueled by local players' desire for convenience and competition. The market has seen significant growth in recent years thanks to shifting customer preferences. Meanwhile, local players are strong contenders against international giants like Uber.

Company | Active Users | Average Fare (USD) |

BiTaksi | 50 Million+ | $5-10 |

iTaxi | 20 Million+ | $4-8 |

Yandex Taxi | 10 Million+ | $3-7 |

Uber | Not Available | Not Available (regulations limit operations) |

Scotty | 5 Million+ | $4-9 |

Cabulous | 3 Million+ | $3-6 |

The prevalence of ride-hailing apps can be witnessed by the increasing number of taxi apps entering the app stores. However, the dominant player can vary depending on location. This blog post explored popular Uber alternatives in several countries around the world.

No matter whether you’re on a budget-conscious trip or seeking a unique local experience, there's likely a ridesharing option to suit your needs. So next time you're planning a trip abroad, do your research and discover the best way to get around.

There isn't a single "best" alternative; it depends on your priorities. Lyft offers similar services, while Via might be cheaper for shared rides.

Lyft is Uber's biggest competitor in many regions, offering ride-hailing with similar features.

Ola Cabs is a popular ride-hailing app in India, offering services similar to Uber.

The fares for both services can vary, but Ola can sometimes be cheaper, especially for short rides or during discounts.

Both Uber and Ola have safety features like driver background checks and trip tracking. For details, it's recommended that you check their safety guidelines.