2500+

Successful Projects

The features and functionalities of your mobile app determine its usability and whether or not it meets user expectations. This is crucial in determining whether your app will succeed or fail. Your Fintech mobile app will handle your customers' sensitive financial data. Because of this, your app has to be both user-users and secure to protect users' personal information.

The march toward digital transformation will reach its pinnacle in 2024, especially in the financial industry. This year has seen the ubiquity of banking applications, which has cemented their place in the digital sector. However, what’s behind this phenomenal growth, and why are financial applications turning into the backbone of contemporary money management? This article highlights the critical significance of financial applications and offers a broad overview of the market environment. Table of Contents

The digital financial sector has grown at an unprecedented rate, driven by the combination of state-of-the-art technology and constantly changing customer requirements. According to a new statistical analysis, the financial app market is expected to develop at an astounding pace and be valued at over $X billion by the end of the year.

Due to the declining cost of smartphones, finance applications are now available to a larger segment of the world’s population. Because of this democratization, everyone can engage in the financial ecosystem, including those without access to conventional banks.

Financial technology advancements are constantly setting the standard setting the standard and providing customers with never-before-seen tools and services, from AI-driven investing advice to blockchain-backed security.

Despite its many difficulties, the COVID-19 epidemic hastened the transition to digital solutions. More than ever, people choose to handle their accounts remotely while putting efficiency, convenience, and safety first.

As 2024 draws nearer, it becomes clear that banking applications are more than simply a passing fad—they're essential. Here's the reason why:

Empowerment is a critical consideration in the design of modern financial applications. Features like automatic savings, real-time spending monitoring, and individualized investment advice can help individuals become financially independent and literate.

With just one app, users can now handle all aspects of their finances, from everyday expenses to long-term investments. This integrated approach streamlines financial management and decreases friction.

In 2024, financial applications will place a high priority on strong security measures due to the growing risks of fraud and cyberattacks, protecting users’ personal information and funds.

User permission is the one feature of any personal financial software that needs to function perfectly every single time.

This is due to the fact that hackers and financial criminals often target the banking sector. The Verizon 2022 Data Breach Investigation Report states that social engineering is one of their primary methods. Human mistakes are used in engineering to compromise systems. Phishing attackers, for instance, can pose as bank representatives in an effort to get a user’s password.

To counter this danger, users should have numerous authentication levels. In this manner, if one fails, the attacker will be unable to proceed.

Two-factor authentication and biometrics are required by default for personal financial applications. Biometrics uses a person’s physical characteristics, such as their face or fingerprints, to authenticate them. This works well because hackers find it hard to steal or duplicate them, mainly when doing so online.

Fortunately, because biometric are included into iOS and Android by default, integrating them into your app is simple. To call them, include a small amount of code into your application; there’s no need to be there from scratch.

For two-factor authentication (2FA), a second login credentials are needed in addition to the user’s password. A user's code obtained from the owner’s cell phone owners would be ideal—something the owner alone can access.

According to research by Microsoft and Google, 2FA is one of the most successful authentication techniques, stopping up to 99.9% of automated cyberattacks.

These authentication procedures are obviously just one aspect of strong app cybersecurity. See our post here for further tips on safeguarding your fintech app.

An essential characteristic of all personal financial applications is their capacity to connect the user’s many banks, userland, and credit accounts.

This enables the customer to handle all of their financial matters conveniently in one place.

For example, they can quickly ascertain their total balance rather than manually compiling and adding it from many sources. Account integration is convenient but may reveal information about a user’s purchasing user's. With its assistance, they can identify patterns that would be hard to notice otherwise.

In fact, the primary benefit of owning a personal financial app is account connection. This is because it addresses a grievance that many bank customers have: a disjointed experience. If you want to efficiently manage many bank accounts, you have undoubtedly already dealt with this. Regretfully, doing so usually means using two or three distinct banking applications and then employing a new program to monitor your entire spending.

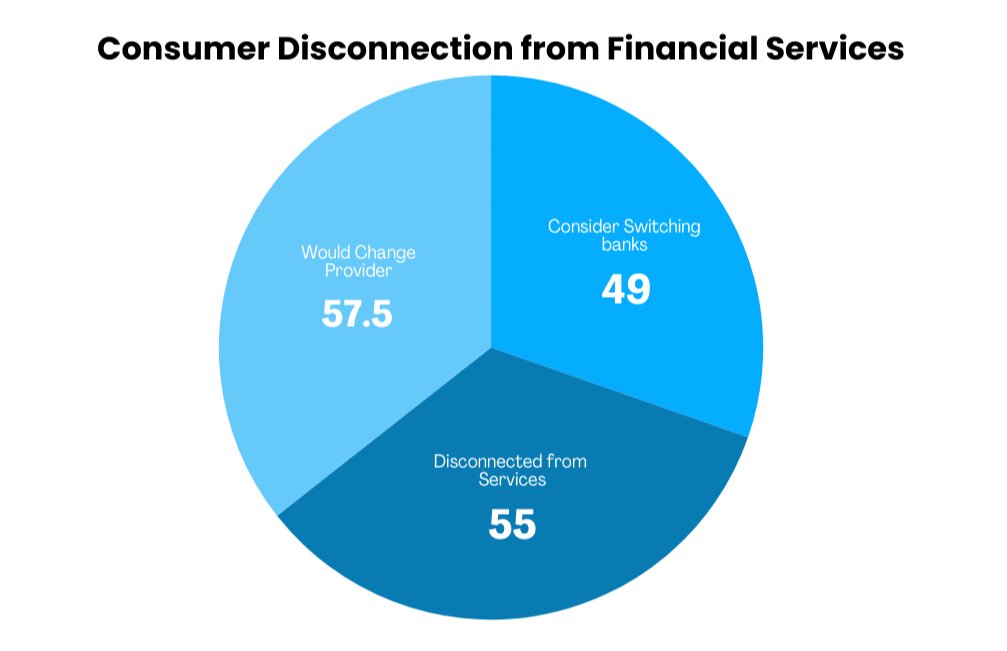

According to a Mulesoft survey, 57% of customers said they would likely go to a financial provider offering a more comprehensive experience since it is such a significant pain point.

57% of customers said they would be open to moving to a financial provider that offers a more comprehensive service. Fortunately, adding bank account connectivity to your app is relatively easy. It’s not even necessary to write the code from scratch; an Open Banking API would suffice.

An application programming interface, or API, called Open Banking, is a technology that allows applications from other companies to access data from banks. When an application wants to access a user’s bank, inform the user's developers that they just need to add the API call to the code.

The primary advantage of using bank account connectivity APIs is flexibility. When integrating, you usually don’t have to account in each bank; the API takes care of it. With only one API request, the Plaid API, for example, facilitates connections to hundreds of platforms and financial institutions.

It goes without saying that accessing a user's financial information without appropriate security and privacy measures is dangerous. Your next top priority is that.

Several finance applications allow you to manage your credit cards and other financial accounts. This function allows you to monitor your credit card balances, track expenses, and make payments while on the road. Additionally, some applications provide features like reminders for impending payments and credit score monitoring.

Another crucial component of financial applications is their history of transactions in real-time. This function, which often comes with push notifications, gives customers real-time information on the activity associated with their accounts. Real-time transaction monitoring offers customers access to several additional features, including report management and expenditure tracking tools, as well as the ability to identify and stop unlawful transactions and make educated financial choices.

Due to the pandemic, paper money is becoming less popular, and fewer people are carrying currency at all. Peer-to-peer, or P2P, payments allow

for online money transfers between customers’ accounts using a smartphone app. Adopting a smartphone app with peer-to-peer (P2P) payment features ensures that funds are deposited quickly and securely, giving users more convenience. P2P payments made using mobile banking apps are safer, more reliable, and cost-free than those made through third-party vendors.

More than only in other areas, push notifications are an essential tactic for financial applications and personal finance apps in particular. Kahuna's research found that the application of the financial services industry is the most significant push notification engagement.

This is because push alerts are essential to financial apps. They notify the user of any significant financial events, such as money entering their account or an urgent bill that has to be paid. Instead of waiting until the end of the month to find out whether they are overpaying, push alerts can assist consumers in real-time. Push alerts have the potential to be excellent tools for motivation when used properly.

Since adhering to a budget may be challenging, it’s a good idea to remind customers when they manage to remain on track. Take a look at how the Level app achieved this (and how its positive message is valued by users). Push notifications are also essential for security. They can alert consumers to questionable activity, including when someone else tries to access their account.

By giving people early notice, you could stop a breach by allowing them to take action. But it’s essential to avoid using push notifications excessively. Users may get irritated and disengaged if you send them too many pointless messages.

The best course of action is to get their consent before sending them alerts. Outlining the advantages is essential to improving the likelihood of people opting in. Push notifications will rank among your personal finance app’s most valued functions if you utilize them sparingly and in the proper context.

Digital payment is another essential feature, and it may be at the top of the list for most customers. In this age of cashless transactions, every mobile banking app must provide instant access to various digital payment options, such as UPI, mobile wallets, and others.

It’s simple for customers to manage their accounts, schedule recurring payments, and pay their invoices. It would be beneficial to set up recurring payments with an automatic deduction from the user’s account since the user could forget when payments are due.

Additionally, a Fintech app with digital payment options frees users from having to visit the bank to access their cash by enabling them to conduct transactions and view account information while on the go.

People use finance applications everywhere; for many of them, language option is a crucial feature. Users may choose the language that is most comfortable for them by selecting from a variety of language choices offered by many banking applications. Regardless of their preferred language, customers can easily browse the program and manage their funds thanks to this functionality.

A successful financial app should have robust security features, seamless banking system integration, real-time updates and alerts, customizable options, and an intuitive user interface. Together, these components provide a setting where users can handle their money with assurance, make wise choices, and engage with the app often.

Financial applications that satisfy users' needs while providing a safe and user-friendly platform have the potential to build trust, boost user loyalty, and thrive in the cutthroat digital market.

Therefore, take advantage of the opportunity to enhance user experiences, boost engagement, and maintain your leadership position in the digital banking sector. If you want your financial applications to have every feature listed above, use our services for financial app creation. Our reputation for offering superior financial app solutions sets us apart as a frontrunner in the field. Come work with us to achieve even greater success with your financial services.