2500+

Successful Projects

Table of Contents

Understanding the foundations of mobile app development before creating a financial application is crucial. Based on our observations, an excellent financial app has an intuitive user interface and smooth operation. By being aware of the fundamentals of app development, you can ensure that your mobile app satisfies user needs.

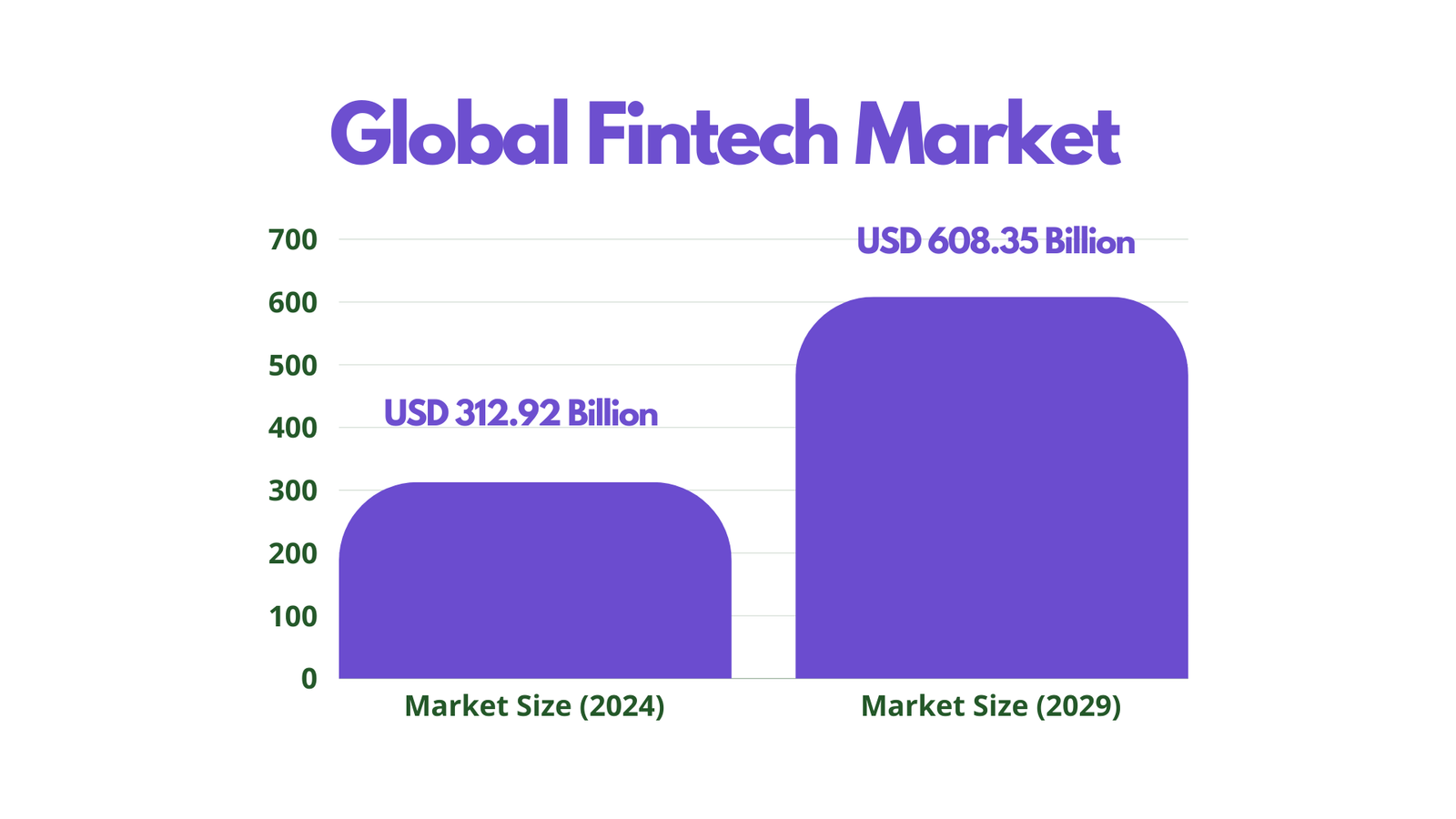

The significance of mobile applications in the banking sector should be among your initial considerations. People's lives have grown more reliant on mobile applications, which let them handle their money while they're on the move. Finance applications provide accessibility and ease for tasks like monitoring spending, making payments, and checking account balances. So, the Global Fintech Market size is estimated at USD 312.92 billion in 2024, and is expected to reach USD 608.35 billion by 2029, growing at a CAGR of greater than 14% during the forecast period (2024-2029). Source: (mordorIntelligence)

Furthermore, the exponential increase in mobile app adoption has been facilitated by the proliferation of smartphones and the rising prevalence of internet access. Recent data indicates that consumers are projected to download 143 billion mobile apps from the Google Play Store by 2026. This startling statistic demonstrates the market's enormous potential and demand for banking applications.

90% of Americans reportedly utilize Fintech nowadays. Fintech is, therefore, used by a larger percentage of individuals than social media (72%) or video streaming (78%).

Among the fintech categories with the highest growth are financial applications.

It should not be shocking to learn that statistic. Many depend on applications to handle their accounts since they are not skilled with money.

Any app that claims to assist users in resolving this problem will become popular.

If you want to create the next central personal finance app, you've come to the right place. But first, you need to consider the reasons for developing a financial app.

These applications are capable of the following.

Finance applications have brought about a revolution in cashless transactions. Users no longer need to look for ATMs when they can swiftly finish transactions by scanning their phones. Because of the additional layer of protection provided by finance mobile applications, users' financial information is protected against fraudulent transactions.

Banking applications allow users to get banking services from any location without visiting a physical branch. Your users now have the flexibility to handle their money whenever they choose, from the comfort of their home or on the road.

Because credit and debit balances are updated instantly, consumers can easily monitor their spending patterns. For added protection and peace of mind, the majority of banks now enable customers to immediately disable their debit or credit cards via their smartphones in the event that they misplace them.

Without the need for money orders or wire transfers, a user may send money to anybody, anywhere in the globe, with only a few clicks. For instance, Wells Fargo has mobile banking applications that make it simple to move money domestically and internationally while guaranteeing your security via authentication.

The Finance App Development Process

The process of creating a financial application involves numerous crucial phases. Here we'll walk you through:

You need to start by coming up with a unique and original concept for the financial app. In your decision-making process, consider user patterns, global reach, and scalability. Additionally, consider your FinTech product's unique selling proposition.

At this point, it is essential that you concentrate on thoroughly understanding your target audience. Find out what their expectations are and what they require. It is crucial to keep in mind that the market should be researched to ascertain its strengths and weaknesses, as well as the potential future direction of the industry and competition.

Choose the most appropriate tech stack based on the project's scope, programming languages, thread detection technologies, and app architecture. Choose the best tools and platform (iOS, Android, or both?) for your app as well, taking into account whether you are working with an in-house development team, a freelancer, or an external partner.

At this point, the development team should decide on the financial app's intended functionality, with the technological stack centered on flexibility, debugging capabilities, scalability, and security.

The product information model and the technical requirements for developing the application are included in this phase.

Recall the unique selling point of your FinTech product; in this case, developing a distinctive design is as essential to success.

Above all, the UX/UI design has to be clear, transparent, and straightforward for people to utilize.

Currently, it's also worthwhile to monitor icon design trends to learn about the most popular graphic components and what to use when designing your application's interface.

Given that the personal financial app needs to be refined before being made widely available, testers need to be included at this point. During finance app testing, you may fix any mistakes to improve the user's intuitiveness and satisfaction.

After disturbing the first MVP version of your application to a chosen user base, you need to be ready to gather comments and suggestions. In addition to producing the initial base number of users, it offers a wealth of aspects of financial applications.

Users may register and create an account using a fintech app. Robust user authentication is required to validate each user's identity since finance mobile apps record and support financial transactions. One-time passwords (OTPs) or login forms may be connected with user authentication capabilities in a system. The software should allow users to change their passwords securely in case they forget them.

A FinTech mobile app's user account provides various features, such as transaction logging, service access, and personal preference modification. Users get access to every feature that makes financial applications unique.

A FinTech mobile app's user account provides various features, such as transaction logging, service access, and personal preference modification. Users get access to every feature that makes financial applications unique.

FinTech apps should allow users to connect their bank cards to facilitate easy online transactions. Users should be able to add, view, and manage their debit and credit cards in addition to their account information.

Push alerts and notifications may provide users with pertinent information and updates. Your financial app may notify users about events like sales, promotions, account changes, etc. Notifications ensure user engagement by consistently delivering messages and alter.

Money transfers and transactions should be feasible via the Internet. FinTech applications are created with a payment gateway integrated to provide the functionality.

A Fintech app may include a wide range of functionalities that can be customized to fit specific business requirements.

Many new mobile technologies vary depending on the kind of application you want to create. You may choose between developing an iOS or Android app or using a cross-platform solution.

Concerning Native Android Applications | |

Programming Languages | Java and Kotlin |

Databases | MongoDB, MySQL, PostgreSQL, and SQLite. |

Payment Gateways. | Stripe and PayPal |

iOS | |

Programming Languages | Swift |

Databases | MongoDB, MySQL, PostgreSQL, and SQLite. |

Payment Gateways. | Stripe and PayPal |

Concerning Applications Across Platforms | Appcelerator Titanium, Flutter, Ionic, Xamarin, and React Native are used in mobile applications. |

Java and Kotlin are the two finest languages for developing financial apps. Let's continue reading to learn more about these languages in depth.

Many of the world's largest banks have been using Java for more than 25 years, and it remains a vital programming language despite the advent of new technology. It is the preferred technology because of its high degree of security and effective handling of large amounts of data.

Due to its versatility, Java is a desirable choice for many different types of financial applications, including big data apps, Android apps, IoT devices, and commercial software.

Although software professionals disagree greatly about Java code's verbosity, Kotlin has steadily emerged as the primary substitute for Java. The greatest Java features are combined with a simpler, more current technology that solves Java's main shortcomings: Kotlin. This programming language is often used to create Android mobile and online applications.

Swift is a compiled programming language for Linux, watchOS, macOS, iOS, and tvOS apps. Apple developed it in 2014, and it is open-source. It has amassed a sizable community and a range of third-party tools. Swift's syntax promotes orderly and consistent code, offering protection against mistakes and enhancing readability. This language makes creating quick and seamless apps easier for iOS developers.

Database | Benefits | |

PostgreSQL | Has strong analytical capabilities | Comparatively low reading speed |

My SQL | Hire Performance | It’s difficult to scale |

MongoDB | Highly Scalable | Memory-Consuming |

Oracle | High performance and portability capacities | High performance |

The programming languages and frameworks often utilized in the creation of financial apps are briefly described below:

Google developed the well-known open-source UI software development kit, Flutter. Flutter is well regarded in the financial app development community for its rapid development, expressive and adaptable user interface, and hot reload functionality, which facilitate rapid revisions and expedient cross-platform app construction.

Developers can use web technologies such as HTML, CSS, and JavaScript to create mobile, web, and desktop apps using Ionic, a robust cross-platform framework. Ionic is preferred in the banking sector because of its user-friendly interface, broad community support, and capacity to develop feature-rich, engaging applications with a dependable user experience.

Using C# and .NET, developers can create native mobile applications for Windows, iOS, and Android using Microsoft's Xamarin framework. When it comes to developing reliable and scalable financial apps, Xamarin is the go-to option because of its performance, native user interface, and easy interaction with backend systems and APIs.

Facebook created the well-known JavaScript framework React Native to facilitate the development of cross-platform mobile apps. React Native is well-liked in the financial industry for its effectiveness, speed, and capacity to provide a native user experience, which makes it a good choice for creating responsive and aesthetically pleasing finance applications.

A mobile app development platform called Appcelerator Titanium allows developers to create feature-rich financial apps using HTML, CSS, and JavaScript. It is well-known in the finance app development community for its cross-platform interoperability, native API accessibility, and quick development times.

FinTech apps using HTML and JavaScript are becoming more sophisticated and secure as a result of technological advancements. You may make an app that goes above and beyond what people would expect by using the many cutting-edge technologies that are now available. Before you start designing your app, learning about the latest trends in fintech app development is crucial to creating a cutting-edge product for your business. Let's look at the newest technologies down below.

Applications for chatbots in finance are becoming more common. Chatbots help financial organizations save costs and improve customer service by automating client care. The software allows users to quickly and conveniently get more information and support for chatbot problems.

Artificial Intelligence (AI) is beneficial for the development of banking applications since it provides features like automation and personalization. AI may help automate data processing and customize apps.

Blockchain is an innovative technology with many uses. It's safe to use this disturbed database, which is a significant collection of immutable data blocks that are accessible to several users. Digital wallets, apps, NFT, and other contemporary applications are developed using blockchain development services.

It's not totally safe to access a user account with only a user ID and password. Consequently, due to technology, FinTech app users may now access their accounts using biometric credentials like fingerprint and face recognition.

Fintech businesses have transformed our financial practices. They have innovative and creative ideas, but they also run the danger of losing critical data and falling victim to hackers.

Fintech businesses must abide by legal and security regulations in order to lower these risks. These regulations are in place to safeguard confidential information, prevent unlawful activity, and ensure that businesses abide by the law.

Fintech organizations need strong network and app security to comply with regulations. They also have to follow guidelines established by security experts such as NIST and ISO and abide by rules including HIPAA, GDPR, KYC, and AML.

By following these guidelines, FinTech businesses safeguard consumer data and increase public confidence. It also keeps hackers at bay, keeps them out of trouble with the law, and makes them more competitive than other businesses. Because it makes obeying the regulations simple, it also saves money.

Fintech companies must adhere to legal and regulatory regulations to protect customer data and transactions. Fintech apps are subject to many vital rules. This is known as regulatory compliance.

The legal measures aim to prevent fraud and money laundering. Fintech companies need to verify and identify the identities of their customers to abide by these rules and protect themselves and their customers from financial crimes.

Fintech companies must protect their customers' personal data by GDPR. Fintech organizations must take safety measures to gather, manage, and store data securely.

Fintech companies that process payments must follow PCI compliance guidelines to safeguard the private financial information of their clients. The security requirements of these standards are met in the processing, storage, and transfer of credit card data. By following these principles, fintech companies may ensure their customers' payment information is safe from fraud and theft.

Healthcare providers and fintech companies handling patient data are subject to HIPAA regulations. Medical records belonging to patients must be kept private. Fintech businesses must abide by HIPAA regulations to guarantee the security and privacy of their consumers' medical data.

If someone accesses the data, the company can suffer. Robust data security protocols are thus essential.

Encryption is similar to transforming concealed data into a secret code. The data can only be accessed by those who know the secret code, preventing private information access.

Authentication is used to confirm users' identities.

Passwords, fingerprints, or two-step verification may all be used for this. Fintech companies should use robust identity verification processes to protect sensitive data.

Only after obtaining authorization may one see specific products or secret information. FinTech companies should use the proper authorization to limit access to their data to only those who are permitted.

A firewall is a technology that helps protect sensitive data in financial applications. It acts as a wall between a potentially hazardous external network, such as the Internet, and a secure internal network. The firewall monitors all data coming into and going out of the system, preventing anything dangerous or unwanted and letting only authorized data pass.

A firewall is necessary to safeguard sensitive financial data in fintech apps. This information may include names, account numbers, login passwords, and other financial data. The firewall ensures that this data cannot be accessed, changed, or taken without permission.

Vulnerability evaluation and remediation are crucial for securing user data in finance apps. Vulnerability testing finds places in the program where hackers may get access and take information. Remedialization is the process of making such repairs to deter illegal activity and protect personal data.

Network security involves keeping a computer network safe from malevolent parties. This includes data security and network communication channel protection mechanisms.

Network security helps prevent bad actors from obtaining sensitive data. It also guarantees network security when users use it.

The following are the top FinTech app development trends that will impact the industry in 2024:

It is expected that more FInTech apps will use blockchain technology to improve security and transparency.

Chatbots and virtual assistants, two AI-powered technologies, are expected to provide more personalized financial advice.

FinTech apps will continue to use Open Banking APIs to provide new value-added services.

Biometric authentication methods, such as facial recognition and fingerprint scanning, will often be used in FinTech applications to improve customer security and convenience.

FinTech apps are expected to incorporate more DeFi, which offers financial services without intermediaries.

Sustainability will likely be included in more FinTech apps' service and business designs.

Neo-banks, also known as digital-only banks, are expected to continue growing in popularity since they provide customers with more straightforward and more readily accessible financial services.

By following these trends, FinTech app developers may stay ahead of the curve and provide innovative solutions that meet users' shifting expectations in 2024.

The quickly developing field of financial app development holds a lot of promise. Several options range from simple budgeting tools to sophisticated insights powered by AI. The right mix of user-centric features and the technical complexity of the app is essential in an ever-changing industry.

In this field, Flutter has become a vital tool that ensures engaging user experiences while simplifying front-end development. Using the proper technology is essential as we map out the future of financial applications.

We at Mtoag Technologies are delighted with creating unique financial apps using Flutter. Using the most recent advancements in financial technology, we work to ensure your idea succeeds in the face of competition. Are you prepared to start this life-changing adventure? Join us, and together, we can create financial technology history.